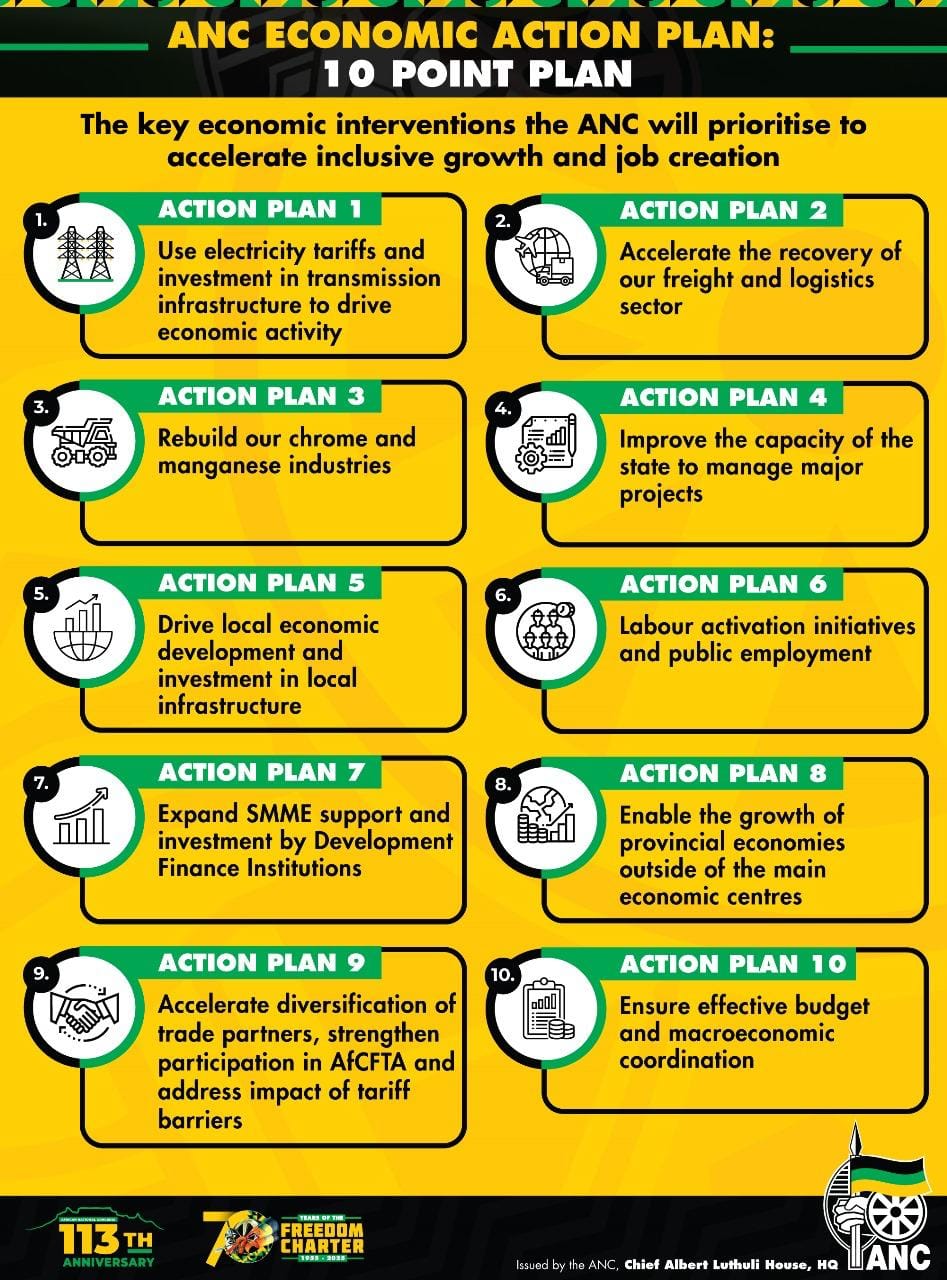

The African National Congress (ANC) has once again placed economic recovery and structural reform at the centre of its political agenda. The party’s 10-Point Economic Plan, unveiled at the conclusion of its special National Executive Committee (NEC) meeting last week, signals an effort to reclaim credibility on the economy at a time when growth remains sluggish, unemployment entrenched, and investor confidence fragile.

The plan comes amid an evolving political and economic landscape: South Africa’s first national coalition government since 1994, persistent infrastructure bottlenecks, and pressure on public finances. Against this backdrop, the new plan reflects a pragmatic attempt to balance fiscal realities with developmental ambition, though questions remain about implementation, coordination, and delivery capacity.

What the plan proposes

The ANC’s 10 priority interventions cover a broad range of macroeconomic and structural themes:

An “Economic War Room” housed in the Presidency will coordinate delivery, track performance through a scorecard system, and hold ministries accountable.

A welcome return to coherence

To its credit, the ANC’s new plan has a coherence and focus that earlier strategies sometimes lacked. It recognises that South Africa’s crisis is not only cyclical but structural: weak logistics, unreliable electricity, high borrowing costs, and a skills mismatch.

Unlike earlier plans that placed near-total faith in state-led solutions, this one acknowledges the indispensable role of private investment, particularly in energy, logistics, and manufacturing. The emphasis on modernising infrastructure governance, crowding in private capital, and tackling bottlenecks such as rail and port inefficiencies reflect lessons learned from the past decade.

Equally significant is the attempt to rebalance economic geography. By placing local economic development and township economies at the heart of the agenda, the ANC gestures towards a more inclusive model; one that recognises the uneven spatial legacy of South Africa’s growth path.

The focus on a “War Room” and scorecards may sound bureaucratic, but it reflects a serious attempt to institutionalise accountability and coordination, something policy analysts have long called for. If executed with transparency and real authority, this could help overcome the chronic implementation failures that have haunted previous plans.

The cautious optimism of economists

Reactions from economists have been mixed but cautiously optimistic. Many welcome the renewed political focus on execution and the recognition that without fixing infrastructure, energy, and logistics, growth will remain capped below 2%.

The plan’s macroeconomic prudence, i.e. avoiding populist spending pledges and reaffirming fiscal discipline, has also reassured markets. The ANC has notably resisted calls for aggressive fiscal stimulus or monetary easing, instead emphasising efficiency, crowding-in investment, and aligning fiscal and monetary policy.

Moreover, the decision to link industrial policy with export promotion and regional integration via the AfCFTA could strengthen South Africa’s trade competitiveness, particularly in manufactured goods and green minerals.

Where the plan faces headwinds

Yet as the saying goes: optimism of the will must be measured against the pessimism of the intellect. The ANC’s 10-point plan is ambitious; but ambition has never been South Africa’s problem. The real challenge lies in execution.

Institutional capacity remains fragile

Many of the proposed reforms require technically skilled and depoliticised state institutions. Years of ‘problematic’ cadre deployment, under-investment, and governance erosion have weakened departments and state-owned enterprises. Rebuilding competence will take time and political will.

Political coordination under a coalition government

The plan’s success depends on coherent execution across ministries and tiers of government. Coalition politics, with competing policy priorities and ideological differences, could slow or fragment decision-making. Without consensus on reforms like pension fund mobilisation or logistics concessions, delivery may stall.

Risk of centralisation

While the War Room approach offers coordination, it also risks over-centralising power in the Presidency. For effective delivery, it must operate transparently, with clear authority but shared ownership across departments and provinces.

Fiscal pressure

The plan’s call for mobilising domestic capital, especially through pension funds and DFIs, raises concerns about overreach. Any perception of political interference in retirement savings could unsettle markets. The challenge is to structure these investments transparently, with risk-sharing mechanisms that protect savers while supporting growth.

Policy continuity and investor confidence

Businesses crave predictability. Frequent shifts in industrial or trade policy, as seen in mining and energy regulation, have previously undermined confidence. Consistency and communication will be crucial if this plan is to attract the investment it seeks.

Three levers for success

If the ANC hopes to make its 10-point plan more than another policy document, three levers stand out:

Targeted delivery and sequencing

Rather than spread effort across ten fronts, the ANC should identify two or three flagship initiatives; for instance, the freight rail reform pilot, or the transmission investment rollout, and deliver them decisively. Demonstrating early wins can build credibility and momentum for broader reform.

Institutional reform as the cornerstone

No economic recovery is possible without an efficient, ethical, and capable state. The plan should prioritise merit-based appointments, procurement reform, and digitalisation of government processes to restore trust and delivery capability.

Partnership with the private sector and social Dialogue

The success of the plan will depend on rebuilding trust between government, business, and labour. The new energy and logistics frameworks create opportunities for collaborative investment models, but only if regulatory uncertainty and bureaucratic red tape are tackled decisively.

A plan between hope and history

South Africa has no shortage of plans. From the RDP and GEAR to the New Growth Path, the National Development Plan and the Economic Reconstruction and Recovery Plan, the problem has always been less about ideas than about delivery. The ANC’s new 10-point framework acknowledges this, explicitly linking goals to implementation and accountability.

That, in itself, is progress. Yet execution will require political courage: confronting vested interests, streamlining bureaucracy, and demanding performance from both public and private actors.

If the War Room can genuinely track delivery, enforce accountability, and prioritise a few catalytic projects, it could mark a turning point. If it becomes another layer of political oversight, the plan risks joining the long list of well-intentioned but unfulfilled strategies.

In the ultimate analysis, the 10-point plan represents a moment of pragmatic recalibration rather than ideological reinvention. It recognises that without growth, jobs, and energy security, South Africa’s social contract is unsustainable.

There is much to commend in its realism and coherence. But the proof will lie in governance, i.e. in how swiftly electricity bottlenecks are cleared, freight reforms executed, and local economies revitalised.

Ultimately, South Africans do not need another policy promise; they need visible, measurable change. If the ANC can turn this plan into tangible progress, it may yet regain public confidence. If not, the country risks another cycle of plans without performance, and promises without prosperity.